Fabulous Accountable Expense Reimbursement Plan Template

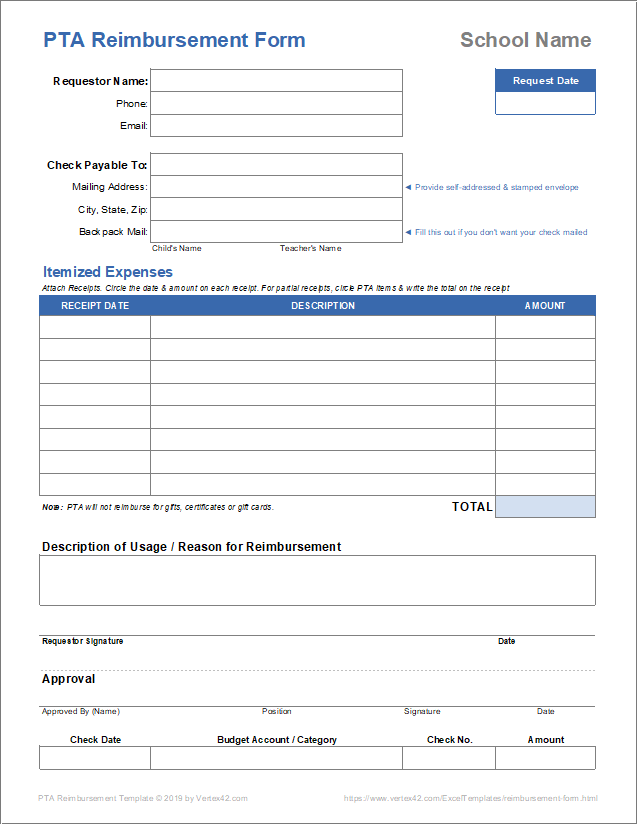

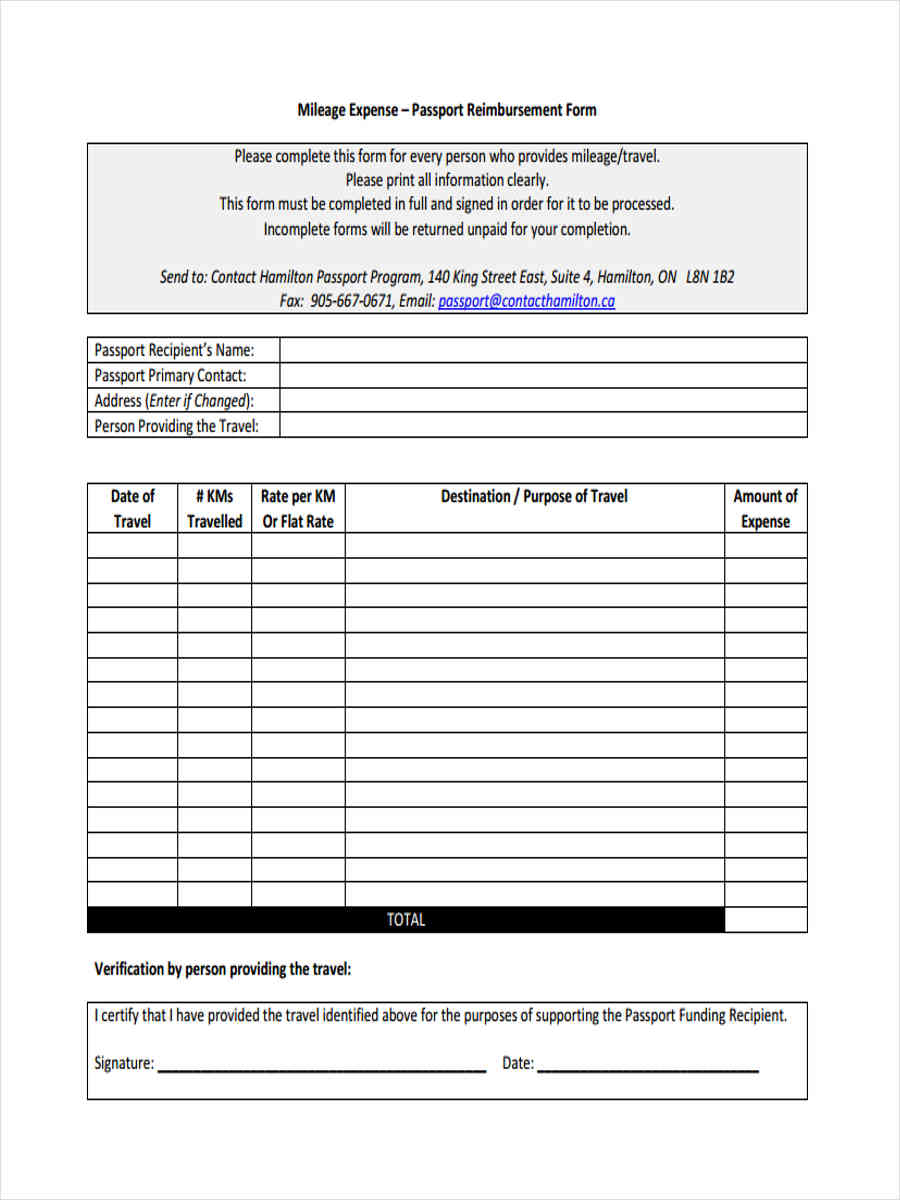

Document additional expenses travel dates and traveler information to ensure accurate and timely reimbursement.

Accountable expense reimbursement plan template. This is how the sales compensation plan should work for reps in a prospecting role. But perhaps more valuable is to see the real travel and expense policies successful companies use. Sales Compensation Plan Examples and Commission Structure Templates.

The plan and planning documents should be provided only to the individuals who have a right and need to access the information whether in electronic or hardcopy formats -- and obsolete copies should be appropriately destroyed. If the claim includes the settlement of an accountable advance it should NOT be entered into FIS by the department. Weve designed a free consulting agreement template to help systematise your practice and be more professional.

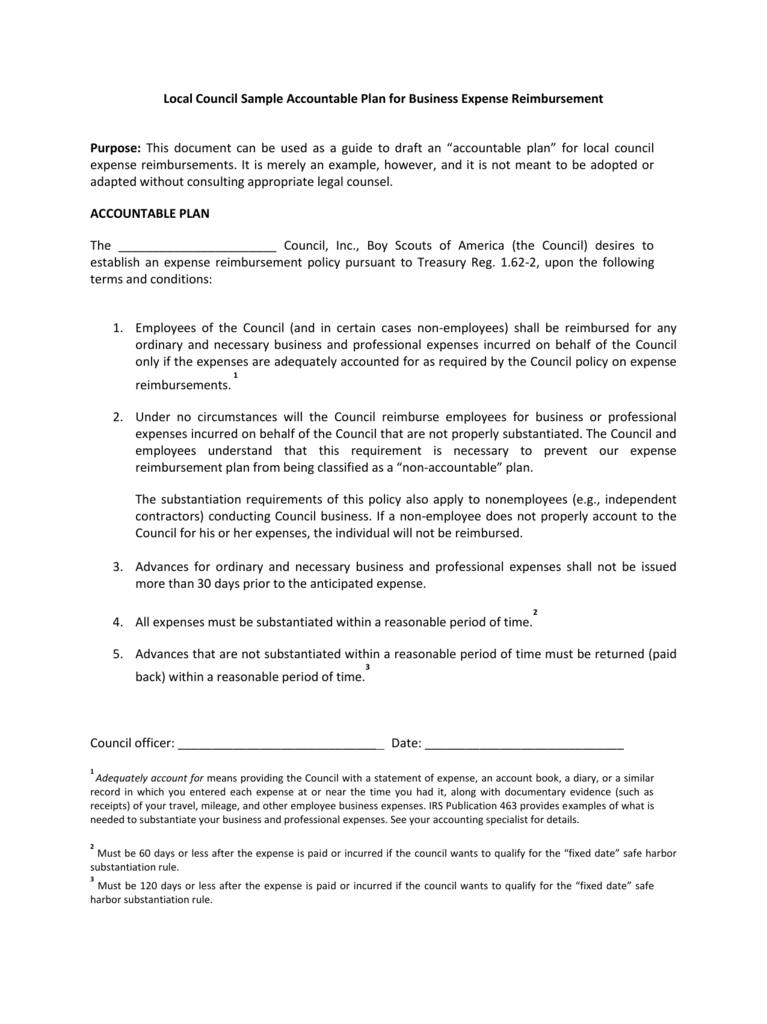

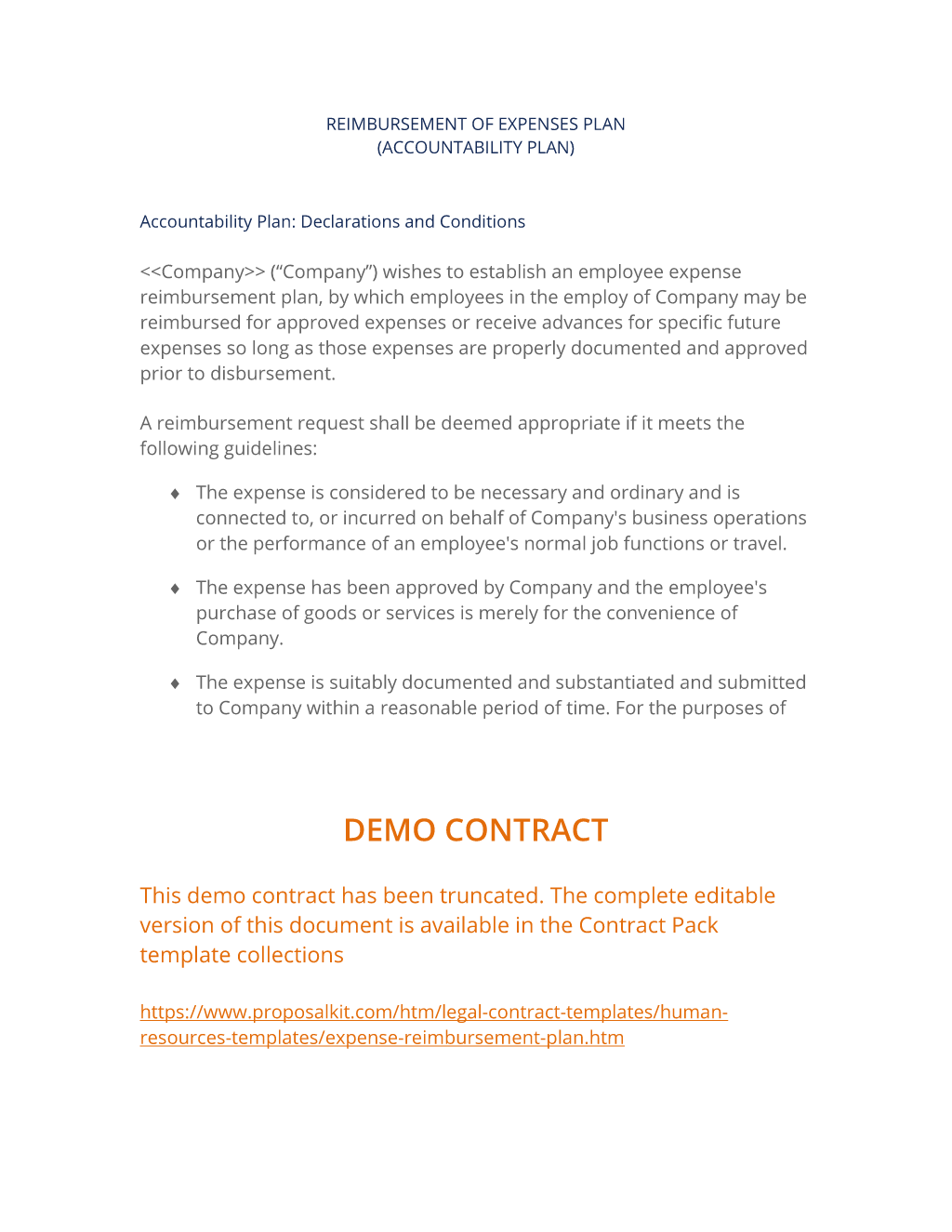

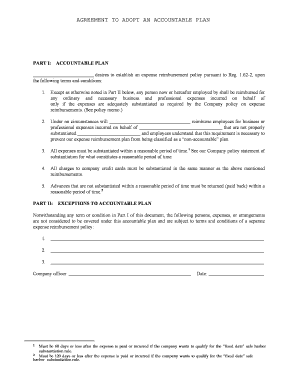

2021 Health Plan Benefit Highlights. An accountable expense reimbursement plan allows for reimbursements for all business-related expenses. For accounting purposes assuming you are using an accountable plan - see IRS Publication 463 I find it simpler to write a separate check than to include the reimbursement in a payroll check.

Reimbursement request forms should be turned in to Payroll DepartmentAccounts Payable. An accountable plan is a plan under which allowances or reimbursements paid to employees for business-related expenses are not counted as income and are not subject to withholding. The company then reimburses the initial cost of the cell phone and the service plan fees each month on.

See Why the IRS Mileage Rate Is Terrible for Business Only a fixed and variable rate car allowance can eliminate tax waste while solving these problems. Weve pulled out the most noteworthy aspects of each below and you can click the links to see them in full. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes.

Treasury Services Forms Federal Employer Identification Number Application. How to create an IRS-compliant expense reimbursement policy. An Accountable Plan is easy to do is a great way to pull money out of the business and actually reduces the amount of taxes paid.