Outstanding 1120s Excel Template

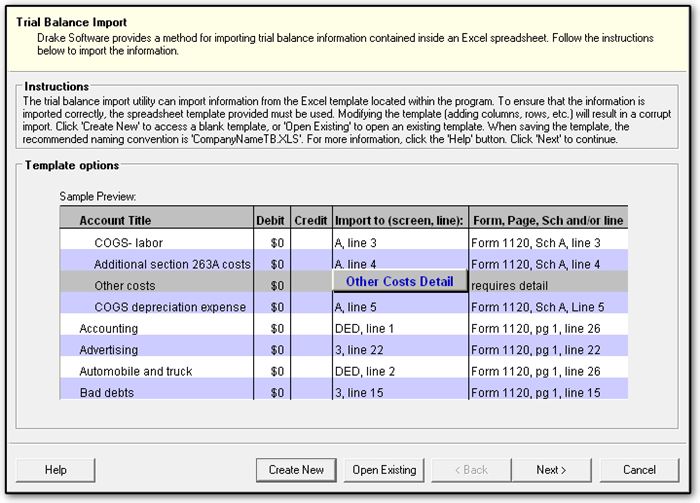

The Trial Balance Import feature is available for 1065 1120 1120-S and 990 returns and is accessible from the main Data Entry screen.

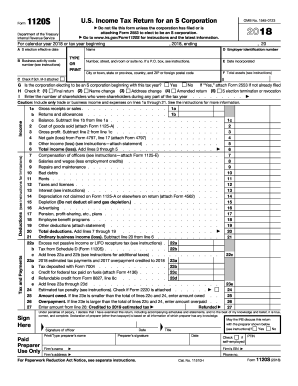

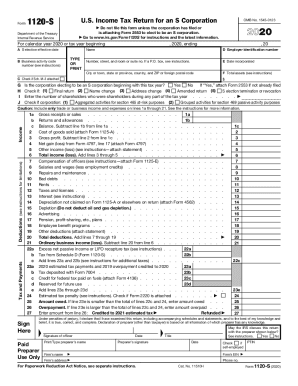

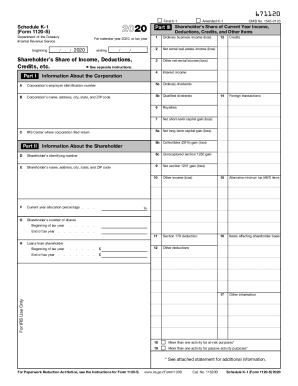

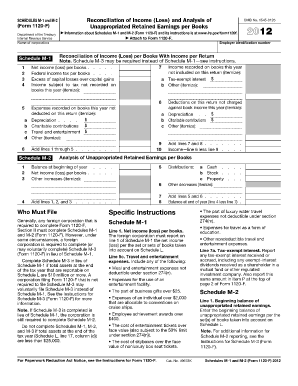

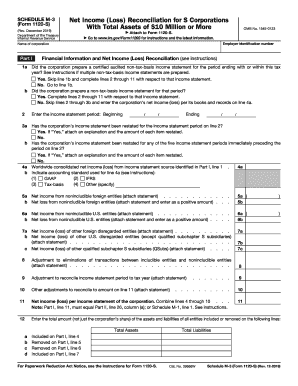

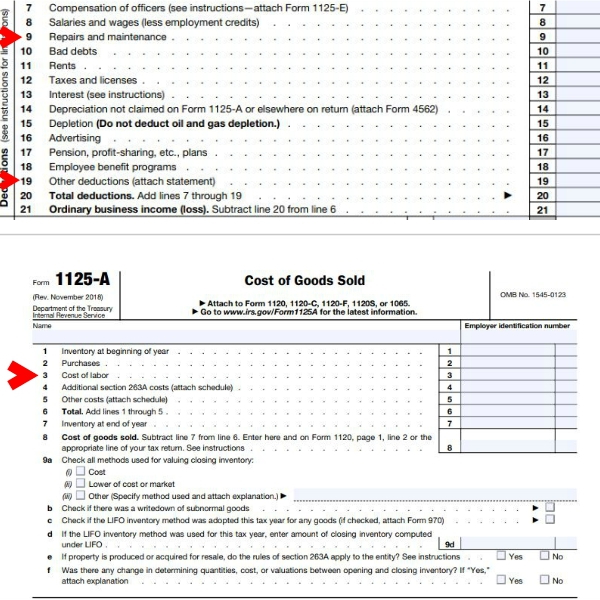

1120s excel template. Estimate the total tax your business might owe including refundable tax credits. Form 1120-S is a federal income tax return designed for use specifically by s-corps. For Form 1065 enter the code 25.

Form 1040 Schedule 8812 Additional Child Tax Credit. Templates below are valid for 2018 and 2019. You can share as well as release your personalized evaluation with others within your company.

Click Import Trial Balance Import to display the Trial Balance Import dialog box. Accrual Yes No c. Enter 20 for 2020 tax year.

If it is for first form 1120S check initial return. Check any box that applies to your business. Inventory and Sales Excel Templatetools you need to manage your money start and run your business successfully and reach your financial success.

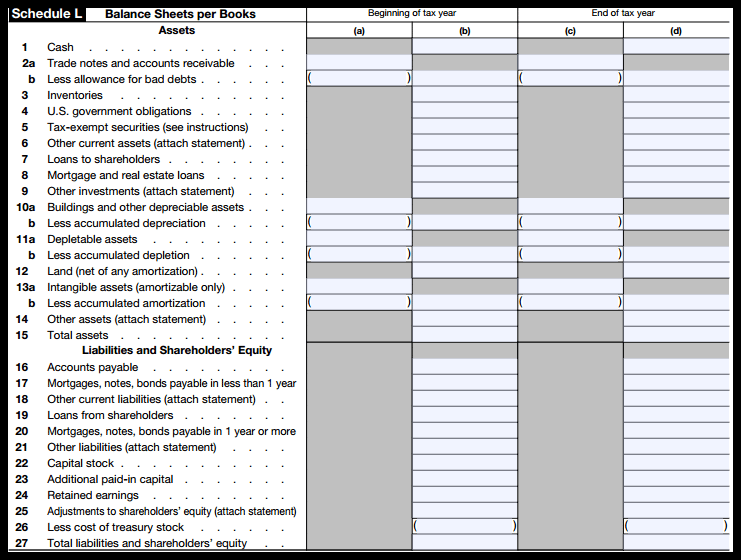

Form 1045 Application for Tentative Refund. Click the Always option if you want the selected tab to display in the Excel spreadsheet regardless of the presence of data in the client. To open the Apportionment spreadsheet choose View Apportionment with an 1120 return open.

The spreadsheet is located at the top of the Apportionment Information window. The spreadsheet consists of three tabs one for each factor. If you are looking for solutions specifically for your business see our Business Templates page.